Vintage Details, Pricing Events, and Exit Information

Performance of All Alumni Ventures Funds, as of Sept 30, 2025

NOTES

- Fund Vintage is defined as the year in which a fund was closed to investors.

- Total Investable Capital is the capital available to invest after management fees for the 10-year life of the funds have been removed.

- Invested Capital is the capital that the AV funds invested through the end of the period.

- Current Valuation includes uninvested cash and any interest or similar amounts earned or received, and it reflects the fair value of the investments as determined in good faith by AV according to its valuation policy. Unrealized investments are priced at cost and then re-priced upon consummation of an arm’s length transaction or written off as a total loss. Current Valuation of unrealized investments represents the market value as of the last day of the period of any owned publicly traded investments (including holdings with alternative markets such as tokens where liquidity and price certainty may be more limited compared to traditional exchanges), escrow(s), and/or estimated proceeds receivable at a future date. Current Valuation of Exits does not reflect any potential contingent consideration that could increase gains received on the investment or incentive allocations payable to AV in accordance with applicable investment terms, which would reduce the amount of distributions payable to investors upon realization of fund holdings.

- MOIC (Multiple on Invested Capital) is equivalent to the multiple of return gross of fees and equals (Current Valuation + Amounts Returned) / Total Investable Capital. Reported performance would be lower if the impact of fees were reflected.

- TVPI (Total Value to Paid-In Capital) is equivalent to the multiple of return after the impact of management fees, taking into account any incentive allocations paid, but does not take into account incentive allocations unpaid and accrued in connection with Current Valuation. TVPI equals (Current Valuation + Amounts Returned) / Total Paid-In Capital. Reported performance would be lower if the impact of potential incentive allocations were reflected.

- 2025: partial year.

Interpreting the Data

Considerations for you as you evaluate these numbers: This annual performance data reflects the aggregated performance of every AV fund which began investing in each year. Individual fund returns may be higher or lower than the aggregated performance. All AV funds are materially different from one another, whether due to investment focus, alumni connection, vintage, investor base, or other factors.

Current Valuation, MOIC (Multiple on Investable Capital), and TVPI (Total Value to Paid-In Capital) are metrics describing the total “paper valuation” of the portfolio. This includes realized distributions already paid out and unrealized changes to a company’s valuation based upon a closed round of financing, from which AV's incentive allocation would be deducted before any amounts are distributed to investors. Except for Amounts Returned there is no assurance that any additional value can be obtained in the future.

Often, one can expect the MOIC to be around one and the TVPI to be less than one in the early years. Winning companies typically take some time to shine, while losing companies usually struggle to scale and fail early. All funds are designed as 10-year funds, and most need 6+ years to mature before a clear view of performance can be seen.

According to Cambridge Associates, fund performance takes quite some time to become meaningful: Based on analysis of over 2,000 private investment funds raised between 1995 and 2005, “most funds require about six years before they ‘settle’ into their ultimate quartile rankings as measured by IRR.”

Summary of Alumni Ventures Pricing Events, as of Sept 30, 2025

NOTES

- $-Weighted Time Since Investment is in years and is based on the sum of the following for all investments: each investment’s original invested amount multiplied by the time since investment, divided by the aggregate invested amount.

- Includes Converted Notes.

- No Change includes any changes in value due to accrued interest on convertible notes.

A Note About Valuation

Valuations reflect the total fair value of the portfolio as determined in good faith by AV according to its valuation policy.

Unrealized investments are recorded at cost, and are only re-valued upon consummation of an arm’s-length transaction, either an Up-round or Down-round in a portfolio company, in accordance with this policy, or written off as a total loss if AV so determines. Up-round generally means a financing subsequent to AV’s investment has occurred at a higher per-share valuation (more favorable) than AV’s original investment. Down-round generally means a subsequent financing has occurred at a lower per-share valuation (less favorable) than AV’s original investment. Amounts Returned is based upon an amount received in the event of an Exit (such as an acquisition by an acquirer) or an initial public offering (IPO), or similar proceeds. Exits include escrows and amounts receivable at a future date but do not include contingent compensation that may not be realized. Public holdings are publicly traded securities priced at market value as of the last day of the period and include holdings with alternative markets, such as tokens, where liquidity and price certainty may be limited, such that expected value received in an exit may be materially different.

Recent Exits in the Alumni Ventures Portfolio

The table below reflects each Exit of a portfolio company investment from an Alumni Ventures Fund from 10/01/24 to 09/30/25. Only certain AV funds invested in any particular investment appear in this table. This table, or any portion of it, does not represent the investment experience of any specific investor. This table does not include the many AV fund investments that have not yet experienced an Exit, and those investments may fare better or worse than those in the table. The names of the portfolio companies and the exact dates of investments and exits have been hidden due to confidentiality requirements of the companies.

Data current as of Sept 30, 2025.

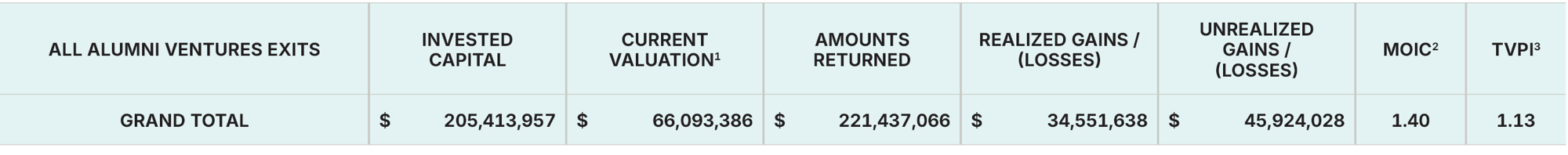

All Exits

Data current as of Sept 30, 2025.

NOTES

- Current Valuation includes uninvested cash and any interest or similar amounts earned or received, and it reflects the fair value of the investments as determined in good faith by AV according to its valuation policy. Unrealized investments are priced at cost and then re-priced upon consummation of an arm’s length transaction or written off as a total loss. It represents the market value as of the last day of the period of any owned publicly traded investments (including holdings with alternative markets such as tokens where liquidity and price certainty may be more limited compared to traditional exchanges), escrow(s), and/or estimated proceeds receivable at a future date. Current Valuation of Exits does not reflect any potential contingent consideration that could increase gains received on the investment or incentive allocations payable to AV in accordance with applicable investment terms, which would reduce the amount of distributions payable to investors upon realization of fund holdings.

- MOIC (Multiple on Invested Capital) is equivalent to the multiple of return gross of fees and equals (Current Valuation + Amounts Returned) / Investable Capital. Reported performance would be lower if the impact of fees were reflected.

- TVPI (Total Value to Paid-In Capital) is equivalent to the multiple of return after the impact of management fees, taking into account any incentive allocations paid, but does not take into account incentive allocations unpaid and accrued in connection with Current Valuation. TVPI equals (Current Valuation + Amounts Returned) / Total Paid-In Capital. Reported performance would be lower if the impact of potential incentive allocations were reflected.

Important Disclosure Information

The manager of the AV Funds is Alumni Ventures (AV), a venture capital firm. AV and the funds are not affiliated with or endorsed by any college or university. These materials are provided for informational purposes only. Offers of securities are made only to accredited investors pursuant to each fund’s offering documents, which describe among other things the risks and fees associated with the Fund that should be considered before investing. The funds are long-term investments that involve a substantial risk of loss, including the loss of all capital invested. Past performance is not indicative of future results. Opportunities to invest in any security (of a Fund, of AV or in a syndication offering) is not a guarantee that you will be able to invest and are subject to all terms of the specific offering. Diversification cannot ensure a profit or protect against loss in a declining market. It is a strategy used to help mitigate risk.

Contact info@av.vc for additional information. To see additional risk factors and investment considerations, visit av-funds.com/disclosures.